This one's simple: Your brain is designed to avoid pain — not manage risk.

- 1

Loss aversion

A ₹500 loss feels twice as painful as a ₹500 gain feels good. So traders hold losers, waiting for "just a small bounce."

- 2

Survival wiring

Your brain treats losses as threats → triggering fight, flight, or freeze. Most traders freeze.

- 3

The illusion of control

Closing a losing trade feels like admitting defeat. So traders avoid the decision, even when the price clearly invalidates the trade.

- 4

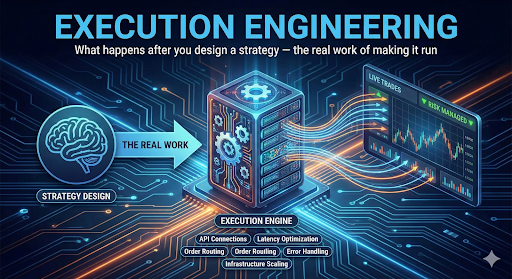

Quants solve this by using rules, not emotions

Quants don't "feel" losses. They predefine exits, automate them, and never negotiate with the market.

The Truth

Stop-losses don't hurt. Ego does. Discipline protects you from your own biology.

Ready to experience AI-powered market intelligence?

Join thousands of Indian traders who've upgraded their understanding with Yuktrix. Start decoding markets today.

Try Yuktrix Free