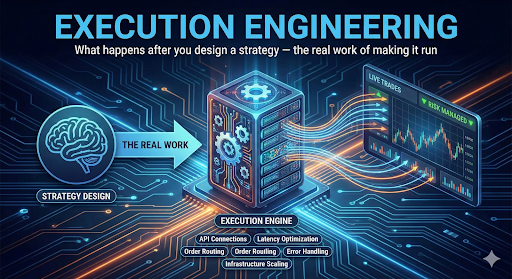

Your chart doesn't decide your profit. Your execution does.

Here's what traders rarely understand:

- 1

Your order becomes information

The moment you place a large market order, the system knows it. Liquidity providers adjust spreads, algorithms react, and slippage happens.

- 2

Market orders are the most expensive orders

They cross the spread → instantly pay a hidden tax. Retail traders underestimate this cost — but quants design entire systems to avoid it.

- 3

Volatility amplifies execution errors

During high volatility, spreads widen, order books thin, fills become chaotic, duplicate trades slip in. This is why automation with risk guards massively outperforms manual execution.

- 4

A good strategy is useless without good execution

Pros say: "Half the edge is execution." And they're right. If your strategy is good but your execution is sloppy, you've already lost.

Ready to experience AI-powered market intelligence?

Join thousands of Indian traders who've upgraded their understanding with Yuktrix. Start decoding markets today.

Try Yuktrix Free