Most traders think markets move because of news, indicators, or "big players hitting buy." Reality is simpler — and far more structured.

Every price movement has three forces behind it:

- 1

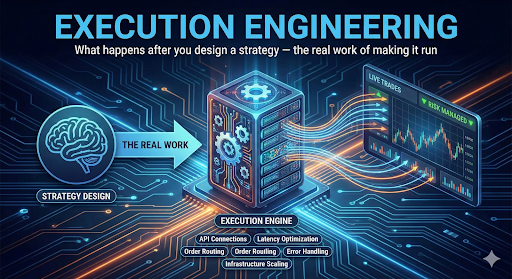

Liquidity (The Fuel)

Price moves where liquidity is thin. Not because buyers are stronger, but because sellers are absent — or vice versa. Most "breakouts" are simply liquidity pockets being hit, not real momentum.

- 2

Positioning (The Pressure)

When too many traders are on one side, the market finds the opposite direction. Why? Because tight positioning creates forced exits — stop-loss triggers → cascading moves.

- 3

Volatility Regimes (The Mood)

Markets behave differently under different "regimes": Calm regime → trends work. Choppy regime → mean reversion works. Panic regime → volatility explosions. Most traders lose because they use the wrong strategy in the wrong regime.

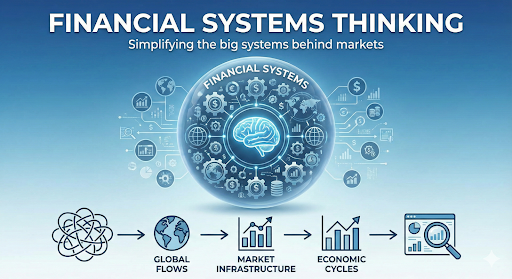

The Takeaway

Price is not random. It's a living system responding to liquidity, positioning, and volatility — not your indicators. Understand the system → understand the market.

Ready to experience AI-powered market intelligence?

Join thousands of Indian traders who've upgraded their understanding with Yuktrix. Start decoding markets today.

Try Yuktrix Free