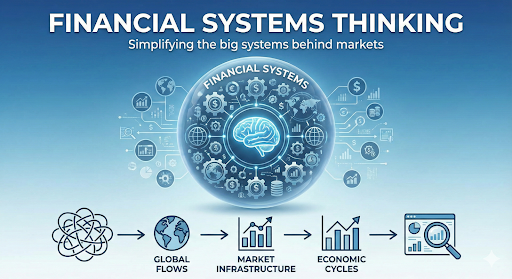

Most traders see charts. Quants see systems.

Here's the truth: The market behaves like a living organism — with structure, reactions, and feedback loops.

- 1

Liquidity is the bloodstream

Everything depends on it. When liquidity dries up → price jumps violently. When liquidity floods → volatility collapses.

- 2

Institutions are the organs

Mutual funds, banks, option writers — each plays a functional role. They create structure, resistance, absorption, and mean reversion.

- 3

Retail is the nervous system

Fast, emotional, reactive. Retail behaviour often triggers short-term volatility spikes.

- 4

Options writers are the skeleton

They create the structure of the market: Strikes, hedges, open interest — all determine where price can move easily.

The Big Idea

If you understand how the system communicates, you can read the market even without indicators.

Ready to experience AI-powered market intelligence?

Join thousands of Indian traders who've upgraded their understanding with Yuktrix. Start decoding markets today.

Try Yuktrix Free